Managing taxes

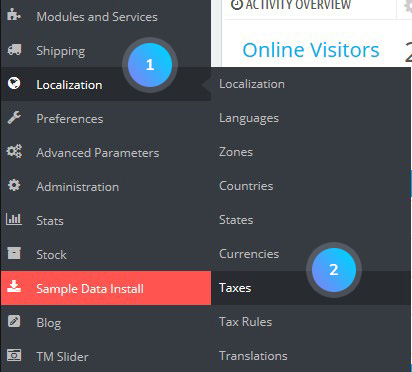

- In your PrestaShop admin panel go to Localization -> Taxes section:

- In the Taxes page, you’ll see a table with all the pre-configured taxes which should be set according to your store default country. In our example the default country is the United States, so the tax rates are for the different states. To edit the options of a tax just click the Edit icon for that tax. You can also disable/enable or delete the tax by clicking on the corresponding icons:

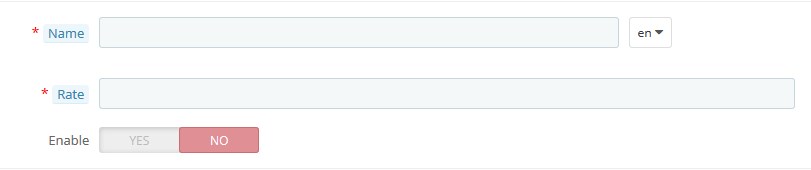

- To add a new tax, click the Add new tax button above the table:

- You can set the following options:

- Name – the title of the tax. It is recommended that you add reminders within the name, such as the country/group/zone the tax applies to, and its rate. This greatly helps you remember which tax is to be used in a tax rule;

- Rate – the exact rate, in the XX.XX format;

- Enable – you can disable and re-enable a tax at any time.

- Click the Save button.

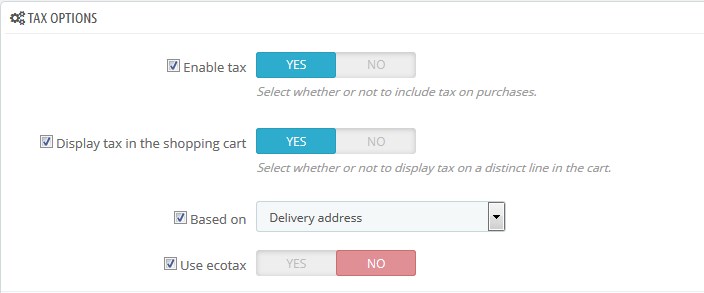

- Scroll down to find Tax options section. These options apply to the whole shop and all orders:

- Enable tax – whether or not taxes are included in each purchase;

- Display tax in the shopping cart – you might prefer the customer not to be aware of the taxes that are applied to the order. In that case, disable this option;

- Based on – the customer can choose to have the product not delivered to the same address as the order invoice should be sent to;

- Use ecotax – the ecotax refers to “taxes intended to promote ecologically sustainable activities via economic incentives”. It is a tax that shop owners pay in order to “feel the social burden of their actions”.

- Save changes.

Managing tax rules

You can use a tax rule to apply different taxes according to the country (or state). You can use a single tax rule to apply different taxes to a product for customers from twenty different countries, for example. What’s taken into account is the delivery (or invoice) address that the customer has provided.

- Go to Localization -> Tax Rules section. Click Add new tax rule button to add a new tax rule:

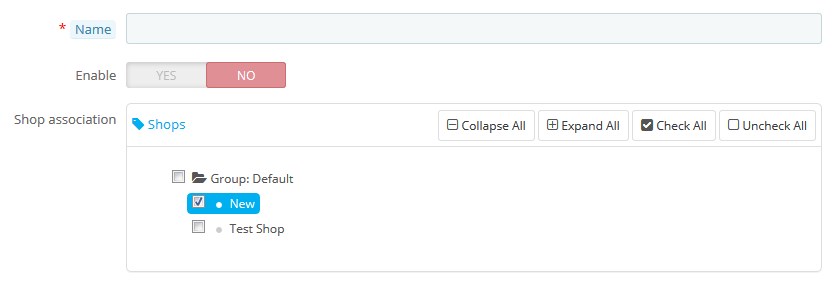

- In the form that appears, you can set the following options:

- Name – the title of the rule. Use the tax rule country code, its name, its rate, to find it easily the next time.e.g. VAT-FR and BE.

- Enable – yes/no.

- Click Save and Stay button. The page reloads with a table header at the bottom.

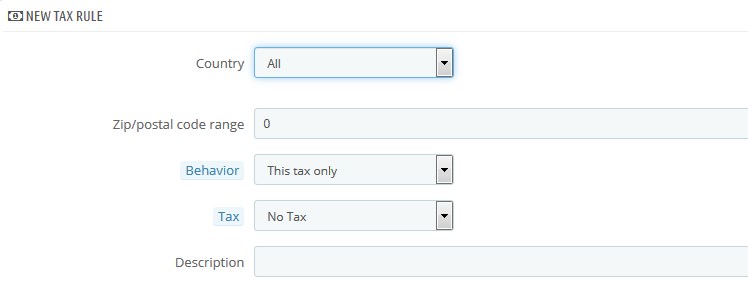

- Additional settings will appear:

- Country -the target country for the rule you are creating;

- Zip Code range – whether the country has registered states or not, you can specify the tax application using the customer’s zip code;

- Behavior – some customers might have an address that matches more than one of your tax rules. In that case, you can choose how this tax rule should behave:

- This Tax Only – will apply only this tax;

- Combine – combine taxes. For instance: 100€ + (10% + 5% => 15%) => 115€;

- One After Another – apply taxes one after another. For instance: 100€ + 10% => 110€ + 5% => 115.5€.

- Tax – the tax to be used for this tax rule

- Description – you may add a short text as a reminder of why this tax rule exists for this country.

Click Save and Stay button to save the changes.

Hopefully, this tutorial was helpful for you.